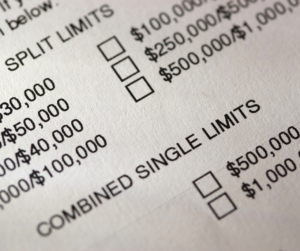

Virginia statute does not require the disclosure of the motor vehicle policy limits of the person who caused the harm in an accident (or the tortfeasor). However, it is accessible by request under certain circumstances. This statute is helpful to those who have been involved in an accident through no fault of their own. Virginia has specific requirements which must be met in order to obtain policy limit information:

Virginia statute does not require the disclosure of the motor vehicle policy limits of the person who caused the harm in an accident (or the tortfeasor). However, it is accessible by request under certain circumstances. This statute is helpful to those who have been involved in an accident through no fault of their own. Virginia has specific requirements which must be met in order to obtain policy limit information:

The request must be in writing and ask the insurer for policies that may be applicable to the claim

The date of the accident must be included

The name and last known address of the person who caused the harm (tortfeasor)

A copy of the accident report (usually in the form of a police report)

The claim number

Medical bills that are at or exceed $12,500

According to this statute the insurer must reply within 30 days.

This can assist the injured’s case by having this information before entering into settlement negotiations. Before this statute was enacted, insurance companies could guard this information and the injured party or attorney would enter into negotiations without knowing the total amount of insurance coverage until after suit was filed. Many cases settle without lawsuits being filed in the first place, therefore in many instances the injured person did not know what the limits were.

This statute is extremely helpful, however, only applies to those with medical bills that exceed $12,500. Therefore, those who have injuries amounting to less than that amount may still have to negotiate without knowing what the limits of the insurance policy are. An experienced attorney will know how to handle negotiations in those circumstances.

If you have been injured through the negligence of another, call the personal injury attorneys at ReidGoodwin today at 804-415-7800 for a free no obligation consultation.